First and fat most, initiating an accurate, reliable payroll system will prevent serious issues for your employees and business. To start there are some phases to consider and here is a brief guide on the topic.

Every business needs to apply for and get an Employer Identification Number (EIN) for IRS purposes. This number is needed to report information about your employees to Federal and state government agencies. The application can be submitted directly to IRS, by fax, or by mail. There might be some additional state and local regulations requirements for EIN, applicable to your area. Make sure to check for such, before submitting your application.

In a scenario in which the employer controls when, where, and how the work is completed and gives financial assets and reimbursement, then the worker is an employee.

There are some obligational documents each employee must fill in, such as a Federal Income Tax Withholding Form W-4 and an I-9 form.

In general, the employer chooses how to distribute the salary, except for some states in which is obligatory for employees to be paid according to a certain schedule, for example, weekly or bi-weekly.

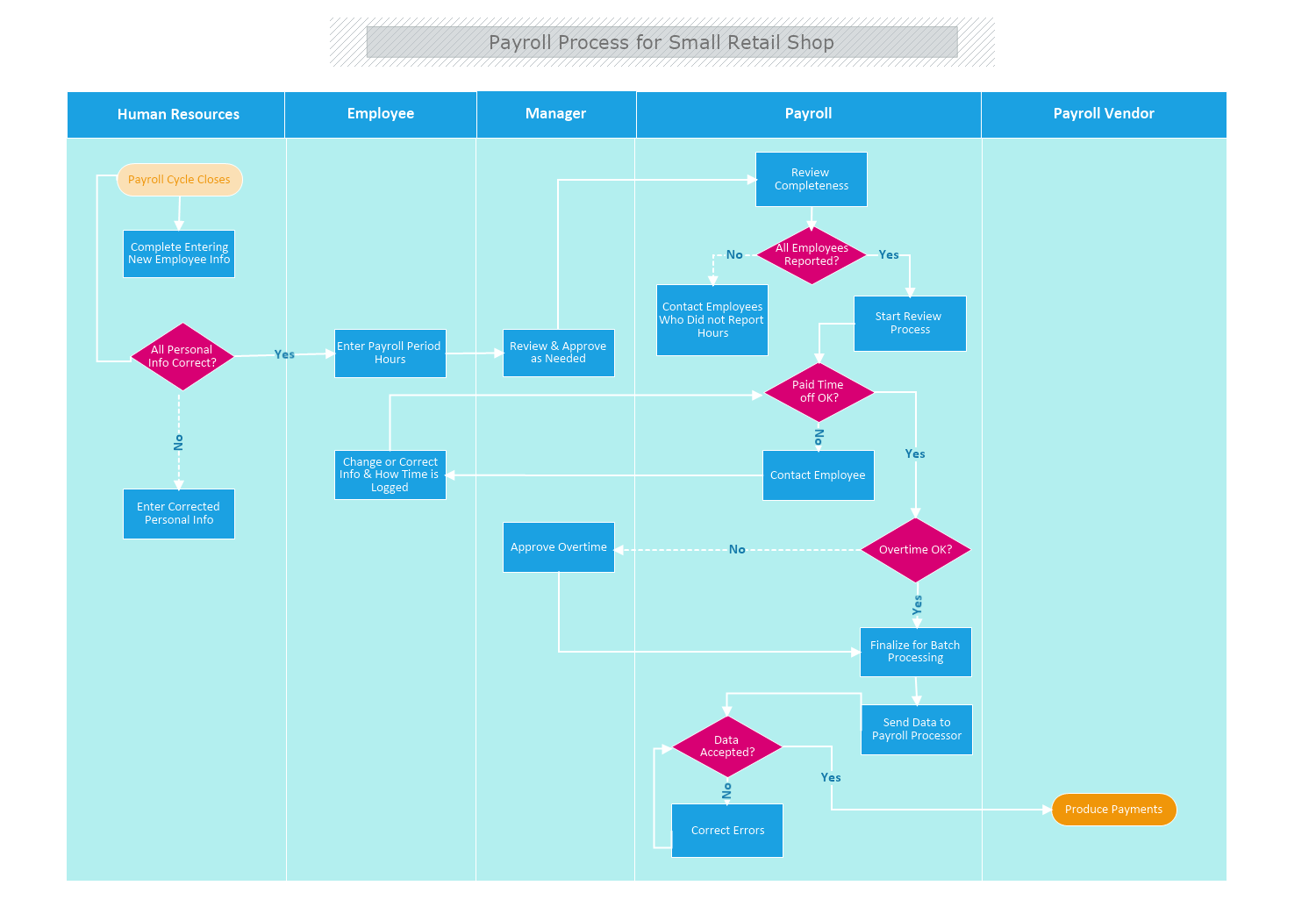

To make your payroll all of the employees’ personal information have to be entered into the payroll system. Some employees might be hourly (non-exempt) workers, that have to enter or report the number of hours for each period. Salaried (exempt) workers do not have to report their hours, as their working hours are the same amount each week.

It is important to keep a record of all payrolls, some of which have to be retained for IRS purposes. Have in mind that, most records must be kept for a certain period after employment is terminated.

Employers have to submit reports for Federal and State taxes, most of which are due either quarterly or annually. To make sure all taxes and documents are handled accordingly, make sure to check for resources in IRS and your state tax office.

Each business is required to submit on-time payroll, to avoid employees dissatisfaction and long-term good business relationship.

Processing payroll is the act of compensating employees for their work. It involves calculating total wage earnings, withholding deductions, filing payroll taxes, and delivering payments.

How does an employer/ business process a payroll?