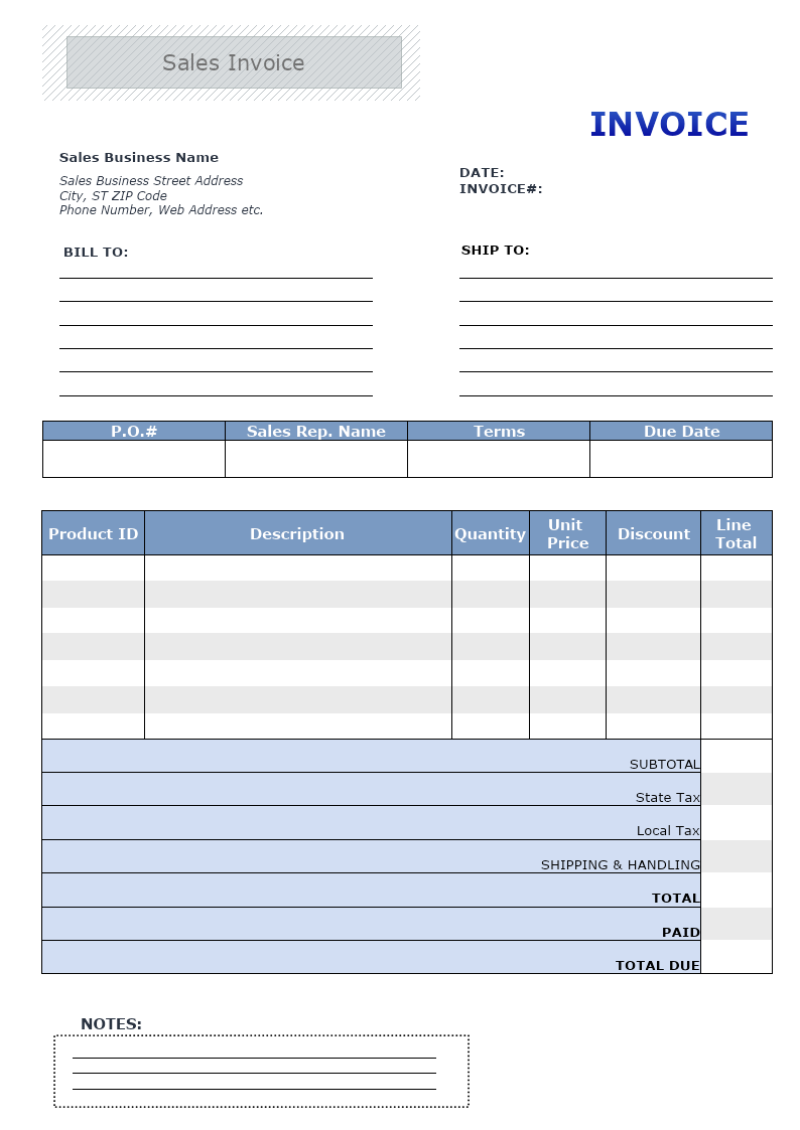

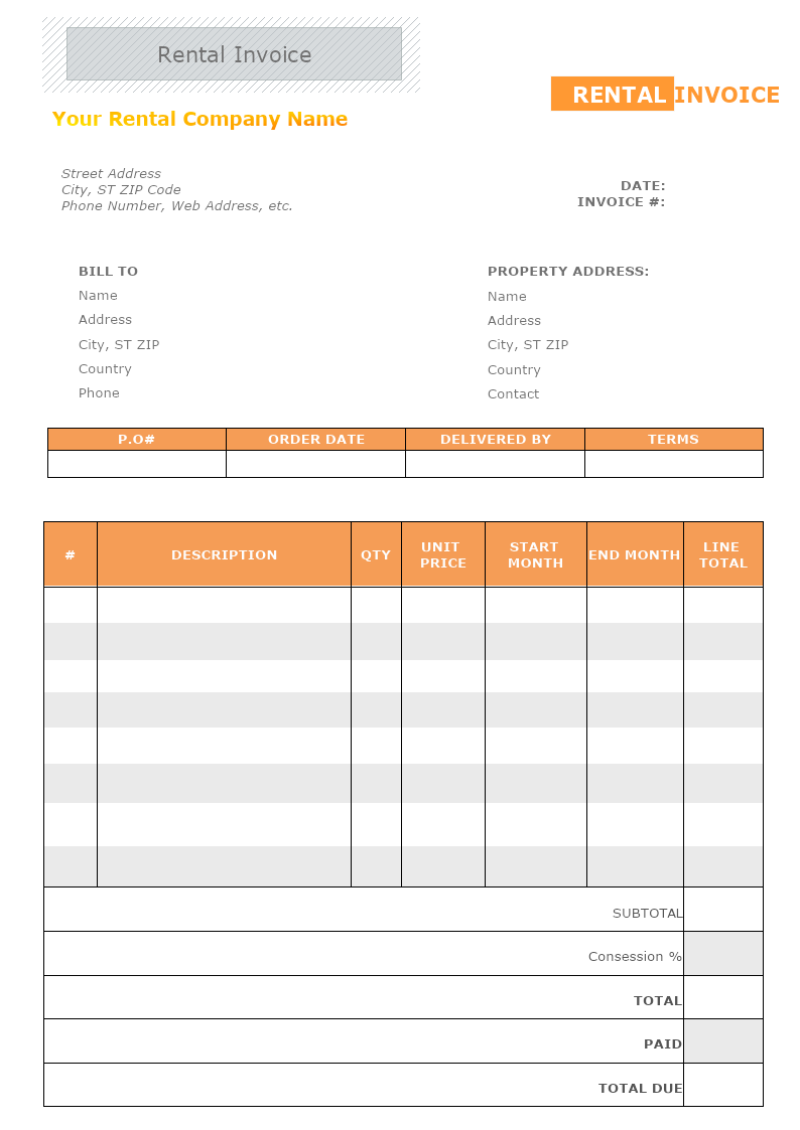

An invoice is a document sent by a provider of a product or service to the purchaser. It is a written verification of the agreement between the buyer and seller of the goods or services. Invoices are an essential part of the business world, as they help accounting keep a track record of the sales transactions.

This type of document has an important purpose for both the business sending the invoice and the customer receiving it. For the company, it helps expedite the payment process by giving the clients a notification of the payment that’s due. The benefit for the client-side is that the invoices provides an organized record of an expense with itemized details, and can help with record keeping.

What is an Invoice used for?

In terms of usages, they serve businesses for a variety of purposes, including:

- To request timely payment from clients

- To keep track of sales

- To track inventory, for businesses selling products

- To forecast future sales using historical data

- To record business revenue for tax filings